Who would have thought, all the way back in mid-January, that the Federal Reserve and pandemic would become secondary factors driving public market volatility and a slowdown in private capital fundraising? I didn’t and said as much here. Yet he we are, roughly three weeks into the Russian invasion of Ukraine, and three days after an extraordinary CPI print from the U.S. Bureau of Labor Statistics, and these two developments, respectively, have subordinated the influence of the Fed and virus to second-tier status in the overall macro-economic landscape. Even the most perfunctory intuition suggests that none of the above will be good for startup funding activity, nor, for that matter, any capital raising, including that raised in the public markets where new issues and SPAC formation has materially slowed down. But it wouldn’t be accurate to conclude that the Fed, the virus, inflation, and the Russian invasion – the four horsemen of today’s macro-economic apocalypse – are killing funding activity outright. Despite the numerous indications that the trend is correct – a slowing of activity – funding remains steady on a relative, historical basis. However, given the current macroeconomic conditions, it’s unimaginable that funding frequency, volume, and asset values, will not be negatively impacted in the short term.

An Extra-ordinary Macro.

The best way to get a sense of how extra-ordinary the macro-economic backdrop is right now is to think about the four horsemen – virus, Fed, inflation, invasion – within a probabilistic context. In doing so it’s useful to define categories that describe, in probabilistic terms, the nature of the risk that each represents.

Category 1 (CAT1), defines those factors that precipitate risk (narrowly defined). CAT1 factors can be described as those in which all potential outcomes are known, and each outcome has a calculable probability.

Category 2 (CAT2), defines those factors that precipitate uncertainty. CAT2 factors can be described as those in which all potential outcomes are known, but probabilities for each outcome cannot be calculated.

Category 3 (CAT3), defines those factors that precipitate ignorance. CAT3 factors can be described as those in which neither outcomes nor probabilities can be known.

Note: CAT 3 factors are those that were infamously described by the late Donald Rumsfeld, former Secretary of Defense during the Iraq War, as “unknown unknowns”.

With this framework in place, let’s go back three months and take a closer look at how the macro-economic backdrop has evolved.

Back in December, inflation, the Fed, and the virus were all in play. The two factors that were easiest to evaluate – the virus and the Fed – were CAT1 factors. We knew the Fed was going to begin monetary tightening by winding-down open-market bond purchases and raising the discount rate. We also knew that the Omicron variant was less lethal than Delta and that despite the surge in cases, data showed – from South Africa and the United Kingdom – that infection rates dropped as precipitously as they climbed. In both cases, the potential outcomes were known, and analysts were capable of assigning probabilities to them accordingly – by way of example, the Fed’s “dot plot” provided data to assign probabilities to the number of rate hikes we’d see in 2022, and U.S. vaccination rates combined with South African and UK infection data allowed epidemiologists to assign probabilities to spike duration, and both infection and mortality rates.

In combination, these two factors added risk to the macro-economic backdrop.

We also knew there was inflation in December. More accurately, rising inflation. The CPI was up 7% for the trailing twelve months, the magnitude of which hadn’t been seen in 40 years. And the underlying CPI, excluding food and energy, accelerated – meaning it came in higher than economists had predicted.

Given the magnitude and acceleration of inflation, and the continuing pandemic risk that fed into herky-jerky central bank monetary policy and supply-chain disruptions, assigning probabilities to 6–12-month inflation readings became virtually impossible, thus rightfully making inflation a CAT2 factor.

When combining inflation with the Fed and the virus, the three factors added risk and uncertainty to the macro-economic backdrop.

Now, let’s fast-forward to this week and the status of the Russian invasion of Ukraine. More importantly, the unprecedented economic sanctions that have been implemented. The current status of the invasion and sanctions beg of the ‘law of unintended consequences, as is typical in geopolitical conflict. As such, there’s no way of accounting for which outcomes are even possible. This makes the Russian invasion and the global economic fall-out from sanctions a CAT3 factor, one that leaves all of us in a state of abject ignorance.

Investment bank take…

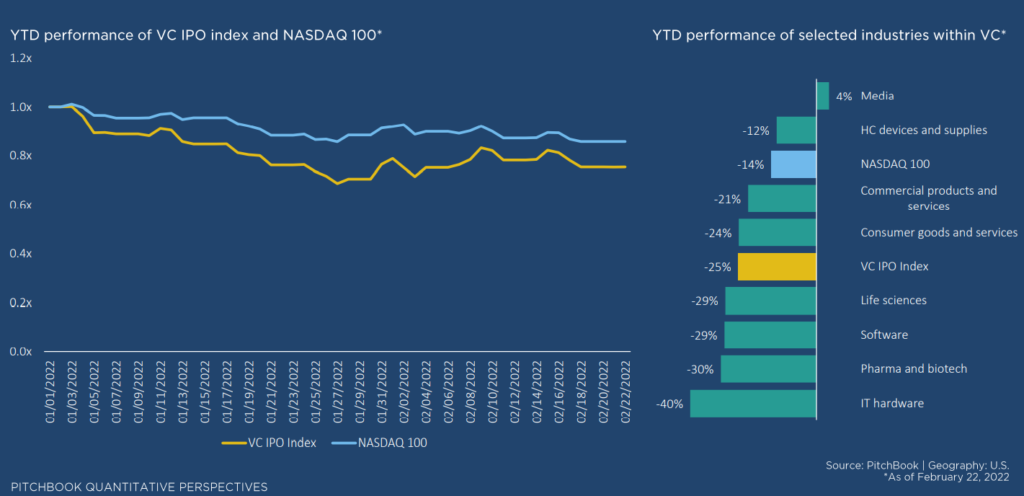

We know there was a mad rush in January to raise investment capital ahead of the anticipated Fed rate hikes. We know there’ has been a slowdown in new issues (IPOs) and SPAC deals with increased market volatility. And we’re beginning to see reporting indicating a slowdown in private market funding – from Crunchbase, here, and from Pitchbook, here.

None of these trends ought to be ignored, but they ought not to induce panic either. They’re the effects of increasing risk and uncertainty in the macro-economic landscape. The consequences of these trends will be a lower volume of capital raised, a decreasing frequency of new funding, and a downward pressure on valuations.

For the bulge-bracket investment banks, this will translate into fewer underwritings and less investment banking fee revenue in comparison to last year’s mammoth take.

For founders, those of startups and take-out candidates, expectations should be set such that they’re aware that market dynamics are shifting, wherein investors will seek greater quality in investable assets – likely in the forms of significant YOY revenue growth, real product moat, and/or a large TAM. And this need for higher quality will act as a countervailing force against the need to deploy the massive amounts of capital that have been allocated for startup and take-out target investment over the past 18-24 months. This will inevitably lead to lower asset values.

Simply stated – when money gets more expensive, and risk and uncertainty in the macro increases, valuations will come down.

But…all of the above doesn’t take into consideration the potential financial shocks that could result from the bugbear of the continuing Russia/Ukrainian conflict and the attendant economic sanctions.

This is scary because there is no way to take it into consideration.

We all understand macro-economic risk in a general sense. But ‘risk’ alone doesn’t accurately describe the breadth and depth of what we don’t currently know of the potential outcomes caused by this conflict.

Because of this, we’re subjected to a macro-economic backdrop characterized by risk, uncertainty and ignorance.

Basically, we don’t know much.

So as the four horsemen of the macro-economic apocalypse continue their ride into the spring, and we continue to inure ourselves to this new and rather uncomfortable reality, it will be incumbent upon investment bankers, investors, and founders alike to stay informed, stay focused, and be extra thoughtful on strategy.

Software & Fintech Investment Bank

Software & Fintech Investment Bank