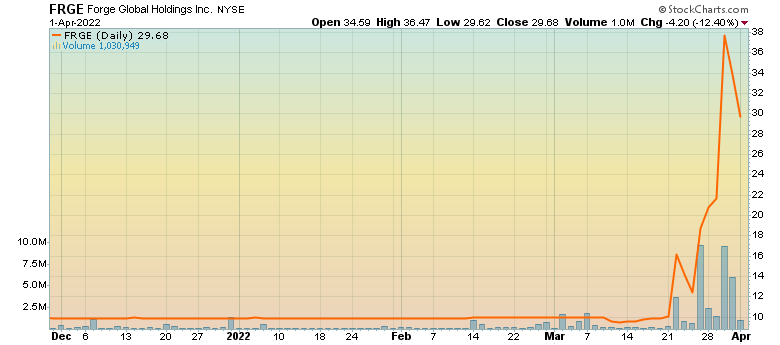

She’s been doing it for more than a quarter-century, starting as a summer intern at J.P. Morgan’s London office in 1987. From commodities trading to derivatives, from blockchain to private equity, Blythe Masters’ accomplishments in investment banking are nothing short of extraordinary, and at least one of the revolutionary. Her most recent achievement comes just two weeks hitherto, on March 22nd, when her SPAC Motive Capital Corp., a spin-off of her sector-specific private equity firm Motive Partners, dedicated to financial technology and financial services investment, formally completed its tie-up of private securities trading firm Forge Global Holdings, Inc. The new entity, trading on the NYSE under the ticker symbol FRGE, closed up 46% on its first day of trading, and as of Friday’s close, up a whopping 168%.

For those who study banking and financial crises as an avocation, Masters is famously known for being the tenacious team member of Peter Hancock’s storied J.P. Morgan “tribe” * that figured out a way to commercialize, at scale, credit default swaps (CDS). Though the idea of removing the credit risk from a bank loan without selling the loan to another party – removing the credit risk while keeping the loan maintained the bank-client relationship while simultaneously attenuating the intrabank collateral requirement set by compliance – had been previously invented by two traders at Bankers Trust, Masters was the first to execute the sale of a loan’s credit risk at commercially significant scale when she sold a CDS from a $4.8 billion line of credit to Exxon by J.P. Morgan and Barclays, to the European Bank for Reconstruction and Development in 1994.

The rest is history as they say. Masters’ CDS architecture went on to be applied to securitized asset-backed loans, which in turn became the ‘food’ that fueled the derivative explosion preceding, and partially precipitating, the Great Financial Crisis. Lost on no student of corporate finance, structured finance, nor investment banking, ought to be that Blythe Masters’ contributions to these fields were revolutionary.

In 2014, Masters was installed as Chief Executive Officer of distributed ledger technology (DLT) and blockchain startup Digital Asset Holdings, LLC. No less visionary than when she worked at, and eventually led J.P. Morgan’s investment banking division, Masters and Digital Asset set out to create a distributed ledger settlement platform to “address the inherent inefficiencies and risks of complex business processes in financial markets.” Specifically, leveraging blockchain and smart contract technology to “eliminate billions of dollars-worth of redundancy, latency, and error costs in the post-trade processing of assets like bonds and equities.” And that’s exactly what she and her team did.

In late 2017, Digital Asset announced that the Australian Stock Exchange (ASX) decided to “green light” an in-the-works project to replace its existing equities settlement system CHESS – Clearing House Electronic Sub-register System – with Digital Asset’s new DLT system after two years of testing. This was, by all accounts, the first time in history that a major domestic stock exchange implemented a blockchain protocol for clearing and settlement, and notched masters yet another unqualified groundbreaking success.

Shortly after, in 2018, Masters resigned from her role as CEO of Digital Asset, resurfacing again in 2019 as CEO and Director of a “specialist” private equity firm focused on growth investments in financial technologies and financial services. Subsequently, she was installed as CEO of a spin-off entity, the eponymous blank-check company Motive Capital Corp., which was incorporated in the Cayman Islands in September 2020, and IPO’d in December 2020. And all this led to her most recent achievement, this month’s business combination of her SPAC with target company Forge Global.

In a capital markets environment where SPACs have become a ‘four-letter word’, and technology IPOs, especially those of fintech, have been few and far between, Motive’s lock-up and merger with Forge Global has been a singular success. Forge’s robust, multi-sided platform, described as “… nearly 400,000 registered users, including over 123,000 accredited investors [with] private shares having been traded in more than 400 companies since inception, representing over $10 billion in volume across 19,000 transactions with buyers and sellers in 70 countries” has made it one of the hottest, financial technology pure-plays globally. So much so, that along with EquityZen, another peer in online marketplaces for trading private companies, pre-IPO shares, likely induced J.P. Morgan to invest in its own, new fintech division, operating in stealth as Project Bloom – Project Bloom ostensibly created to fend off these same investment banking platforms from peeling away J.P. Morgan clients, particularly institutional investors, and transactional fee revenue.

Simply stated, the Motive/Forge merger represents another coup for Masters and secures her standing in investment banking, financial technology, and financial services as a true, titan of industry, with a legacy that will reverberate for decades.

Investment bank take…

From her innovative construction and usage of credit default swaps to her real-world application and implementation of blockchain technology, master’s accomplishments have contributed greatly to the evolution of financial markets and the global banking system.

Her vision in seeing the demand for greater liquidity for founders and employees of pre-IPO companies, and her ability to find a technology platform to serve that marketplace, are what makes the Forge/Motive merger at once, a market success, and another successfully executed endeavor.

Though today’s markets and investors tend to reward pure technologists with fame, celebrity, and fortune – Musk, Dorsey, Bezos, Zuckerberg – Masters, who is very much a technologist too, has more quietly gone about her business, leveraging technological innovation to advance the efficiency, liquidity, transparency and security of markets.

She is truly a master of the investment banking and financial technology universe.

In contemplating her place in history, I’m reminded of another banking and finance revolutionary, Siegmund Warburg, of Warburg banking family fame. He is probably best known for having transformed early twentieth-century merchant banking in London, pivoting away from merchant banking’s long-time staid role of underwriting and distributing new securities, and towards what became modern investment banking’s more activist role in corporate growth through mergers and acquisitions.

In quoting famed U.S. Ambassador and Partner of J.P. Morgan, Dwight Morrow, Sigmund Warburg once said “The world is divided into people who do things and people who get the credit. Try if you can to belong to the first class; there is far less competition.” **

Let there be no doubt.

Ms. Masters is a member of that small group of people who does things.

Additional resources:

* Fool’s Gold – How the Bold Dream of a Small Tribe at J.P. Morgan Was Corrupted by Wall Street Greed and Unleashed a Catastrophe – Gillian Tett

** The House of Morgan – An American Banking Dynasty and The Rise of Modern Finance – Ron Chernow

$FRGE – Software & Fintech Investment Bank

$FRGE – Software & Fintech Investment Bank