In a cycle of high-volatility, like the one we’re currently experiencing in the public markets, the concept of market risk, or the business risk that companies are exposed to as a consequence of market behavior, comes to the fore. In many instances, especially today, the concept is used as a bogeyman to scare investors into allocating capital to alternative investment opportunities, much of that capital re-routed to private funds where investment performance is buffered from the whims of the larger and more liquid public markets. Regardless, for holders of publicly traded equities, and analysts too, the spectre of market risk has a sobering effect, one that precipitates more thoughtful analysis of company fundamentals, wiping away euphoria-induced delusions of future equity performance, and replacing it with cold, penetrating reason to assess the same. And that’s very much what we’re beginning to see, inclusive of commentary this past week regarding equities in the financial technology sector, where analysts are beginning to chime-in, separating the fintech wheat from the fintech chaff.

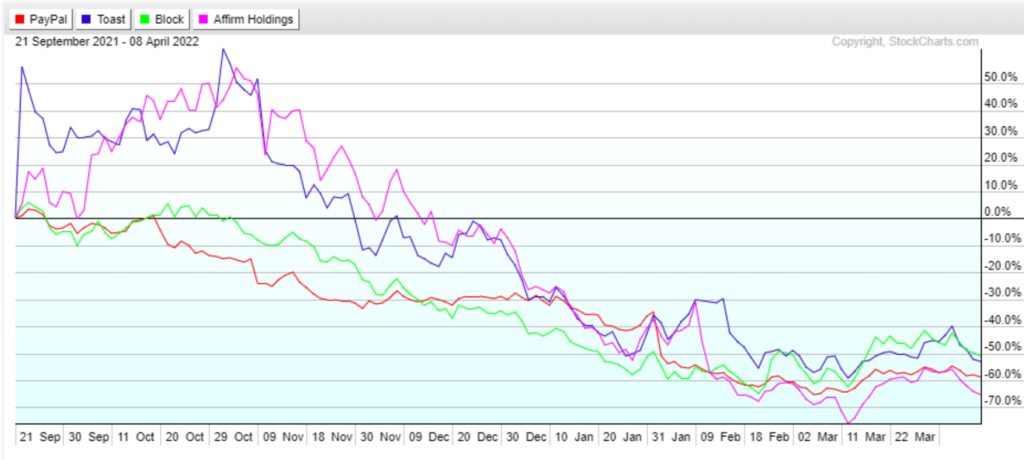

Upon a cursory look, the chart below appears to show four fintech stocks following a similar trend downward within a four-and-a-half-month frame. All four companies, Toast, PayPal, Block, and Affirm received press this week from analysts, albeit for different reasons. But unlike in euphoric cycles when “all equities only go up”, 2022’s high-volatility regime, and consequently, the fear it causes, and the fear that ultimately creeps into investor sentiment, increases the sense of loss aversion, and thusly causes investors to approach their allocation of capital to equities with a much greater degree of scrutiny. Because of this, at least in the analyst community, we’re beginning to see a divergence in opinion, reflected in coverage initiations and buy-hold ratings, as evidenced by these four fintech names.

Fintechs PayPal, Block, Affirm, Toast – Software & Fintech Investment Bank

Fintechs PayPal, Block, Affirm, Toast – Software & Fintech Investment Bank

On Tuesday, analysts at research firm MoffetNathanson LLC issued “words of caution” regarding Toast and Affirm. Toast received a sell rating because, in their words, competition from new up-and-coming, pandemic-born fintechs is “fierce”, and Toast is especially vulnerable to market share capitulation because its end-users constitute a “relatively narrow slice of the payments market” – that being restaurants. Affirm faired a little better with a neutral rating, but none-the-less raised concerns because of the explosion of buy-now-pay-later options, and the headwind of higher financing costs – I would add there’s a regulatory headwind here as well.

On the other side of this week’s fintech equities commentary – the good side – PayPal and Block were beneficiaries. Wells Fargo analyst Jeff Cantwell re-initiated coverage on PayPal and Block with an “overweight” rating, citing in both cases the likelihood of improving financial metrics due to continued growth driven by ecosystem capture from their respective digital wallets and super-app products.

Four fintech stocks. Four similar 140-day chart patterns. But, two different outlooks as closer scrutiny yields a divergence in opinion on future performance.

Investment banking take…

Markets go up, markets come down. There’s nothing extraordinary about this attribute, nor newsworthy, though the causes, both actual and speculative, might be. The same holds true for equities. They go up, and they come down. But what’s often overlooked, and sometimes utterly lost, particularly in an extraordinary bull market, like the one we experienced in 2021, is the correlational strength between companies in the same cohort. In this particular case – fintech.

Though I’m typically loathe to describe a wide swath of financial services companies as ‘fintech’ – lacking further qualification I find the descriptor relatively useless – I do consider the four companies discussed here as solidly representative of fintech assets. All four – PayPal, Block, Toast, and Affirm – are true financial technology companies, whose platforms move money, and in some cases, personal financial information and securities – to and fro via their own, proprietary tech. And because these four fintech are ably representative of the sector, and sufficiently diverse in product offering, they provide a decent sampling to illustrate the divergence in thought relating to their prospects of future performance, such performance to ultimately be reflected in their respective share prices.

The takeaway? Some are wheat, and some are chaff.

Though Wells Fargo’s favorable analyst opinion of PayPal and Block is founded on more nebulous reasoning, I think the conclusion is correct. PayPal and Block are both, two-sided fintech platforms that continue to grow captive financial service and banking ecosystems in a digital world that creeps closer and closer to obviating hard currency and paper-based transaction processes. To my mind, they both do indeed represent the fintech wheat.

The negative analyst ratings put forth by MoffetNathanson for Toast and Affirm, however disappointing for shareholders, are spot-on (IMO), and well supported by their arguments. As such, they both do indeed represent the ‘fintech chaff’.

Of course, these analyses can change. But for now, in a market that offers no place to hide for fintech equities that may have previously benefited from correlational strength to companies with better fundamentals, investors need to ‘thresh’ diligently.