Mastercard (NYSE: MA) earned itself some buzzy media coverage these past two weeks by reporting that the card network of “consumer choice” filed 15 trademark applications for its brand assets in the metaverse. One would be hard-pressed to get more buzz out of a headline if it were deliberately issued by Mastercard itself. But in fact, it wasn’t. The genesis of the story was a report from an intellectual property attorney – Michael E. Kondoudis – who specializes in trademarks, and who regularly posts high-profile corporate trademark filings on Twitter. But what about the substance of the story? Are Mastercard’s trademark filings needle-movers for payments and fintech? Are they suggestive of the next great leap in consumer choice of payment for goods and services? No. Not even close. In the real world, i.e., the non-metaverse world, Mastercard’s trademark filings are hardly noteworthy for any meaningful and substantive technological innovation. In other words, the filings make sense from an operational perspective, but the hype around the metaverse story doesn’t.

The metaverse is an exciting concept, and the first iterations of the virtual reality (VR) and/or augmented reality (AR), immersive virtual worlds have garnered a lot of attention and curiosity from both consumers and corporations. Three names which have received a lot of attention to date are Decentraland, Facebook’s ( now Meta’s) Horizon Worlds, and Nikeland. But what’s lost on many, and by no fault of their own, is that ‘the metaverse’ – singular, not plural– does not exist. At least not in the way that the media, some futurists, and now some corporations portray it. Facebook/Meta has built its own. Decentraland has built its own. And Nikeland, the only one that stands out to me as a commercially viable metaverse construction, is coded into the very popular and already existing quasi-metaverse platform ROBLOX. I say ‘quasi’ because financial transactions and intellectual property authentications in ROBLOX aren’t run on a blockchain protocol, which, though an attribute of the other metaverses, is not a defining characteristic for an immersive virtual experience.

As the metaverse concept continues to gain traction – curiosity and participatory interest from consumers, build initiatives from strategic, and investment dollars from financial sponsors in the venture capital realm – many, MANY, metaverses will be built. The marketing and press that generates the hype around the metaverse are at best ignorant, and at worst, deliberately misleading sleight-of-hand put forth to attract investment. The metaverse, as currently portrayed by the media, big-tech, and corporate interests, is not, and will not, be a single platform, open to everyone to build and interact on – the metaverse construct is not, as some liken it to, an analog of the internet.

As such, Mastercard’s trademark filings should not be looked at through the prism of advances in financial technology and payments product development, but rather, through the prism of insightful and forward-looking operational wherewithal to ensure that its intellectual property – its logo, colors, slogan, business services, and divisions – are properly protected in the many metaverses that are likely to proliferate in the next 20 years. Mastercard is diligent in pro-actively securing its IP, registering its trademarks so that they can be digitally authenticated by way of non-fungible tokens (NFTs) on a native blockchain in any one of the decentralized, AR/VR communities of the future.

I find that fintech, payments, and software enthusiasts, whether investment bankers or investors are more often than not technology geeks too. So, when a slew of publications issues press on Mastercard registering trademarks in anticipation of being active in the much heard of, but not yet well understood, the decentralized economy of the metaverse, the articles are going to attract engagement and commentary.

But the hoopla surrounding these headlines is a gross overreaction, not in the least because there is no single metaverse that exists, or will exist. Mastercard is simply, and smartly, protecting its brand for use in the many metaverses that will likely exist in the future. A historical comparison that comes to mind is the corporate rush to secure the top-level domain ‘.com’ during the tech bubble of 2000. Companies realized that they needed to secure their IP for the internet, even if they didn’t yet have a published website.

Like the misapprehension of a single metaverse, the Mastercard metaverse story headlines belie the reality – a reality that’s absent any newsworthy fintech, payments, or software happenings.

But…

What the past two week’s reporting on Mastercard and the metaverse does shed light on, however, and this is an important insight to pull out from the news, is the proclivity for Mastercard, and Visa for that matter, to hedge their bets relating to their respective roles in any form of future AR/VR construction where financial transactions are performed. This behavior, though not unusual for the major card networks, especially of late in regards to crypto and blockchain technology, is defensive as much as offensive – most likely in anticipation of what appears to be a consensus among metaverse software designers and developers for the disintermediation of legacy card and banking networks, financial institutions, and clearing vehicles. The result of this disintermediation – decentralized, costless verification of transactions – could leave the card networks vulnerable.

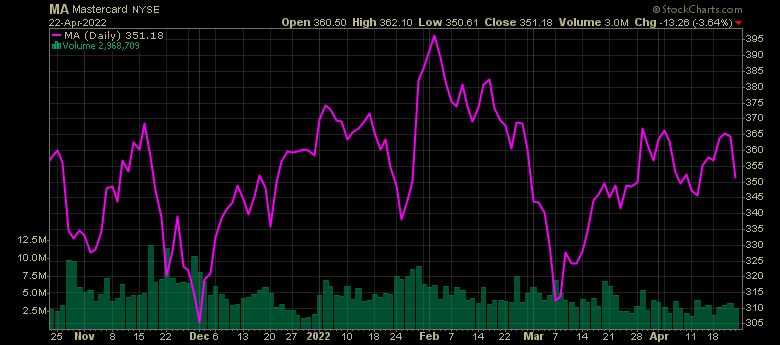

Software & Fintech Investment Banking – Mastercard (NYSE: MA)

Software & Fintech Investment Banking – Mastercard (NYSE: MA)