Market Movements & COTW

PayPal in Play: Assessing Stripe as a Strategic Acquirer

Recent speculation about a potential acquisition of PayPal (NASDAQ: PYPL) has intensified, driven by its significant stock decline. The shares have fallen 40% over the

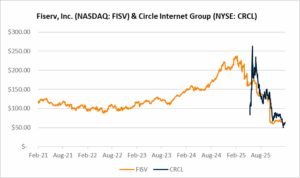

NASDAQ: FISV

Fiserv, a major player in payments and financial services technology (NASDAQ: FISV), officially launched INDX on February 12, 2026. This is a real-time cash settlement

Strategy Inc (NASDAQ:MSTR) and BitCoin (BTC)

Bitcoin (BTC) printed a record high of $125,000 in October 2025 but dropped about 45% to $69,000 by February 14 after bouncing from recent lows

A Tiered Approach to Federal Reserve Payment Access

Federal Reserve Governor Christopher J. Waller first proposed the concept of a “skinny” master account (also referred to as a “payment account”) last October, during

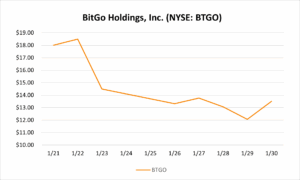

BitGo Holdings, Inc. (NYSE: BTGO)

BitGo Holdings, Inc. (NYSE: BTGO) is a leading next-generation digital asset infrastructure company focused on delivering secure, scalable Web3 financial solutions to institutions and high-net-worth

Mastercard’s Agentic AI Strategy for the Payments Layer

We are continuing our discussion of how the largest branded payment processing networks are implementing the next generation of technology to improve their clients and

Visa’s Shift Toward Agentic Driven Commerce

Visa (NYSE: V) is leveraging its custom artificial intelligence (AI) technologies through its Visa Intelligent Commerce initiative. What makes this service stand out is the

Mechanics of Stablecoin Settlement on the Visa and Mastercard Networks

Stablecoins are cryptocurrencies linked to widely accepted and stable assets like the US dollar (such as USDC and PYUSD) and are increasingly being adopted in

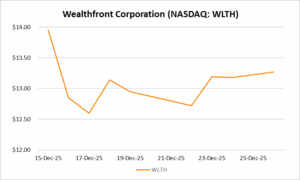

Wealthfront (NASDAQ: WLTH)

Wealthfront (NASDAQ: WLTH) recently issued new shares in an initial public offering, which received a tepid response from investors; the stock trended slightly down in

JPM’s MONY Signals BIG Banks May Be GENIUS’ BIG Winners

We are taking a deeper dive into JP Morgan’s digital asset strategy which includes their internal launch of a tokenized money market fund and adoption

MSCI (NYSE: MSCI)

MSCI (NYSE:MSCI), previously called Morgan Stanley Capital International, manages global stock indexes which serve as key global benchmarks for overseas investment funds. These indexes have

Heritage Global Inc. (NASDAQ: HGBL)

Heritage Global Inc. (NASDAQ: HGBL) is a niche, third-party service provider that helps industrial and financial companies monetize surplus industrial machinery, equipment, and distressed financial